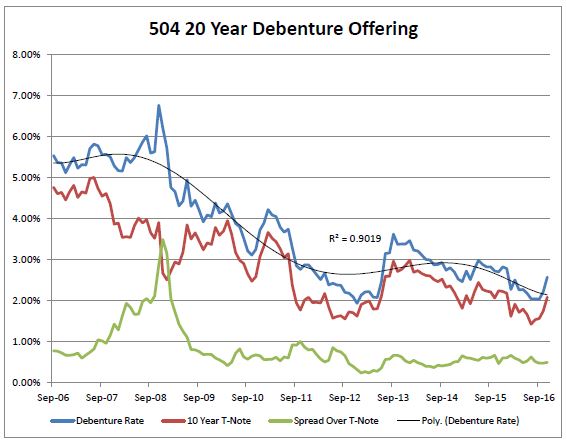

504 December 2016 Rates |

4.596% – 20 Year Debenture Effective Rate * |

|

Hedge your Bets.

The Ten-year Treasury has continued to move upward, after the pricing of the current 504 debenture auction, reaching 2.46% at the close of New York trading on last Friday. This represents an approximately 100 basis point move from the low in the early summer..

Chart and Statistical Data is from September 2006 to December 2016

Given a 90% correlation, which we would argue is understated for the period charted above, to the Ten-year Treasury, it is hardly surprising that the underlying twenty-year debenture rates have moved upward. A pleasant surprise, however, is that the risk premium, the spread between the debenture and the Treasury has actually diminished.

Diminishing risk premiums, the same phenomenon is occurring in major junk bond indices, is quite a positive indicator for the economy, as a whole. But as there is some rough parity, at least in cosmic terms, between what the Bond Market giveth and what the Bond Market taketh away, it does further indicate a rising rate environment.

So as the Bond Market, giveth and taketh, take advantage of the long term fixed rates of the SBA 504 program’s long term fixed rates to hedge your long term rate exposure. The independent terms of first position loan afford a borrower the opportunity to even hedge their hedge, by taking a floating or shorter term rate lock. We welcome the opportunity to earn your business * Note: Rates are subject to credit determination & auction pricing. Past performance is no guarantee of future results. Share this message with the tools below. |