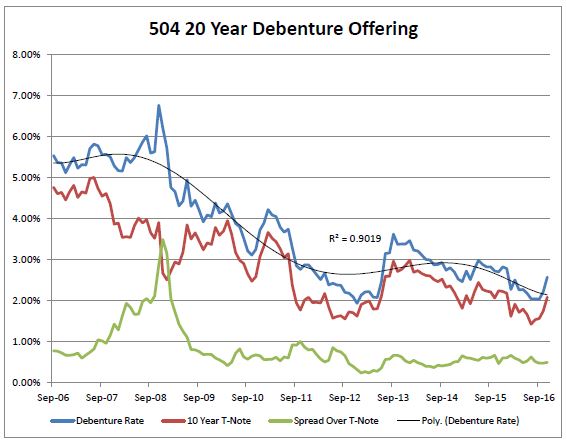

504 February 2017 Rates |

4.607% – 20 Year Debenture Effective Rate * |

|

Market Divergence

On the one hand are the equity markets, which are all but on fire. If we believe in the predictive power of this side, the Fed will hit the prospective three hikes for 2017, likely in quarter point installments. This implies a Ten Year Treasury rate north of 3% by the year’s end.

On the other hand, the Ten Year Treasury has spent much of the past week backing off of recent highs, settling at about 2.4%, which is still well above levels of late 2016. Chart and Statistical Data is from September 2006 to February 2017

Personal income had a weak start in January, inflation has an upward trend-but seems to lack real traction, and the political landscape both at home and abroad remains unclear. What does a small business owner do in times when the future seems more opaque than usual? They control their costs. A major cost for almost any small business is occupancy. Ownership takes rent increases off the list of things to worry about, and the long term fixed rates and amortization of the SBA 504 program takes a rising rate environment off the worry list as well. That the 504 also preserves working capital, through a lower equity stroke, falls providentially under the heading of “keeping your powder dry”. We welcome the opportunity to earn your business * Note: Rates are subject to credit determination & auction pricing. Past performance is no guarantee of future results. Share this message with the tools below. |