SCTD – SBA Fiscal Year Opens with Fee Changes for 7 (a) and 504 Loans

|

Costs of SBA credit go down for FY 2016

|

with Fee Waivers and Reductions on Primary Loan Programs

How many lenders in the past 24 hours have been wondering: “Is this the Third Party Lender Fee?”.

Lots. And, no doubt to the disappointment of some, it is not the “Third Party Lender Fee”. Thus for the typical banker quoting a 504 project to a prospect, nothing in your bank’s pricing model has changed.

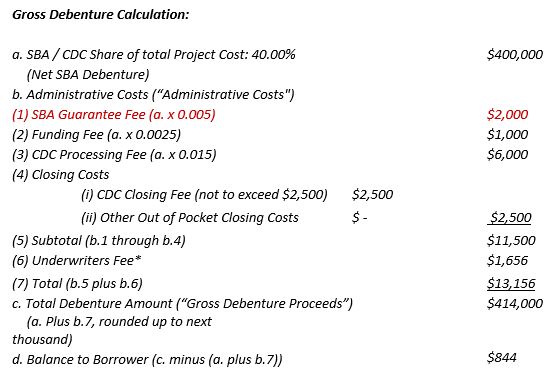

So, for the intellectually curious, what fee is being reduced to zero? It is the “borrower” SBA Guarantee Fee which is built into the Gross Debenture. (See Below-The Net Debenture relates only to eligible project costs; the Gross Debenture includes the costs of Debenture Issuance.)

Nonetheless, 50 basis points (1/2 of 1%) remains an estimable amount, in the example above $2,000. (A $400,000 net debenture is a fairly commonplace example based on a $1 Million project, using a standard 50/40/10% split.)

The other reduction in 504 pricing, is in the “annual fee”; which is actually an add-in to the all-in debenture rate. The reduction of the current add-in to the all-in rate to 0.914% (91.4 basis points) represents a drop of 0.023% (2.3 basis points). As an example the September 2015 lower set for the twenty year debenture all-in rate to full term, had the new pricing been in effect, would have been 4.879%, as opposed to 4.902%.

So for those lenders looking to offer the benefit of a twenty year fully fixed and fully amortizing loan to their borrowers, the price just got a bit more affordable.

SOUTH CENTRAL TENNESSEE DEVELOPMENT

|

|

On October 2, 2015 / News