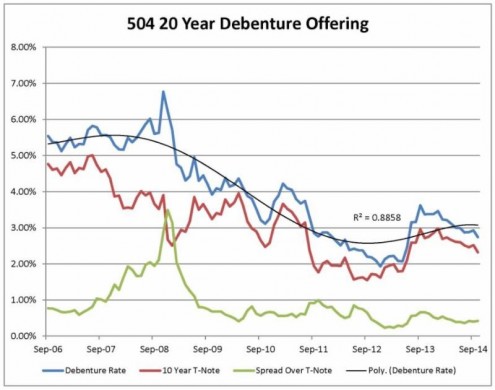

504 Program Rate Update for November 2014 |

4.879% – 20 Year Debenture Effective Rate *4.555% – 10 Year Debenture Effective Rate * |

“If it be now, ’tis not to come; if it be not to come, it will be now; if it be not now, yet it will come-the readiness is all.” |

|

Shakespeare has never enjoyed a reputation as a “Fed watcher” but the quote above may change that, as it goes directly to the heart of the debate as to when the Fed will begin raising rates. At some point, the interplay of US economic growth, global deflationary pressures, and an international political environment of great confusion, will work out toward the Fed raising rates. Chart and Statistical Data is from September 2006 to November 2014

Yet, if it be now or to come, the exact timing is less important than the overall readiness for the eventual coming of the event. How better to be ready for a rising rate environment than with the long term fixed rates of the 504 program? Limiting sensitivity to a rising rate environment serves both borrowers and lenders well and the recovering secondary market for 504 first position loans can amplify this effort. So if we must ignore The Bard’s advice, to “neither a borrower nor a lender be”, let us at least be ready for the eventualities of a rising rate environment. We welcome the opportunity to earn your business. * Note: Rates are subject to credit determination & auction pricing. Past performance is no guarantee of future results. Share this message with the tools below. |